Almost all industrial markets suffered a lot this year due to the COVID-19 pandemic. Power semiconductors market suffered as well. Power semiconductors are semiconductor devices used as a switch or rectifier in power electronics.

In the first half of the year, major semiconductor manufacturers announced a possible decrease in sales in 2020. And this is absolutely understandable because power semiconductors are used in almost all areas of human activity.

Despite the problems the semiconductors industry faced this year, almost all analytical agencies and companies that work in this field forecast a much better future for power semiconductors market. Thus, according to Research and Markets, we can be sure that the market will continue to grow. They say that as of 2019, power semiconductors were a US$ 41 bn global market, or c.10% of global semiconductor market size.

Research and Markets are positive on IGBTs and MOSFETs, given the growing market is driven by rising energy efficiency requirement in multiple applications such as EV, industrial control, and home appliances, and the rising demand for Chinese suppliers driven by a large domestic market and multiple Chinese brands in home appliances, automobiles and industrial look to diversify their supply chains amid growing trade tensions.

The global IGBT leaders usually cover a full range of applications from consumer electronics, automotive, and industrial controls, to power generation, infrastructure, and railway. The global MOSFET leaders usually cover the full range of applications from consumer electronics, automotive, computing, motor driver, power supply, telecom network, EV charging, LED lighting, to medical. Each of these sectors is analyzed in the report.

The rapid growth of the power semiconductor market in recent years has been driven by the proliferation of computer and consumer electronics, such as desktop computers, notebooks, netbooks, smartphones, flat panel displays, and portable media players that require sophisticated power management to improve power efficiency and extend battery life.

You can attain more information in their latest research.

According to Market Research Future, Mordor Intelligence, Transparency Market Research, and other analytical sources, we can expect power semiconductors market to grow at least at a CAGR of 4%. At this rate, the market will become worth almost US$ 55 bn by the end of 2025.

The power semiconductor market according to Mordor Intelligence is growing due to the incorporation of the advanced technologies in consumer electronics, such as smartwatches, smartphones, and IoT devices, to work as small electronic gadgets and in order to facilitate easy access to technology.

The enhanced features of power electronics, such as lightweight, power efficiency, high speed, and enhanced portability are some of the drivers which will further augment the growth of the power semiconductor market, over the forecast period. Apart from technological advantages, power semiconductors are trending, due to increasing consumer interest toward electric vehicles.

Despite the positive outlook for power semiconductors in 2021-2025, the COVID-19 pandemic is wreaking havoc on sales of automotive power semiconductors, with falling demand for motor vehicles causing global market revenue to decline by 16 percent in 2020.

Worldwide revenue for power semiconductors used in automotive applications will fall to $9.1 billion in 2020, down from $10.8 billion in 2019, according to Omdia’s Power Semiconductors in Automotive Report.

My friends from Yole Développement confirm that they are positive about the future of power electronics and semiconductors. That’s what they say in the latest Status of the Power Electronics Industry 2020 report:

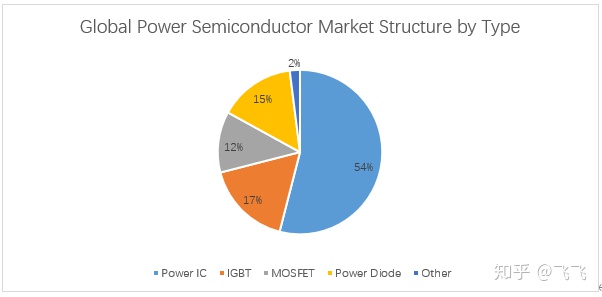

- The global power electronics market accounts for $17.5B, with a 4.3% Compound Annual Growth Rate (CAGR) from 2019-2025. Within this market, we can differentiate three different major driving components: IGBT modules, silicon MOSFETs, and SiC devices.

- Today, the largest share of the power device market is for silicon MOSFET devices, which account for 45% of the total value. The major application segments for silicon MOSFETs are automotive, portable & wireless, computing & storage, and industrial. They are pushed by needs for higher efficiency and increasing global communications. Despite the decrease of automotive and consumer end-system sales due to COVID-19 in the first half of 2020, there is an expected CAGR 2019-2025 of 1.4%.

- IGBT modules, which represent $3.7B in 2019, are traditionally used in applications such as industrial or renewable energy converters. As shown in the report, these applications are today driven by efficiency regulations or increase of clean energy goals, and they account for 46% of the total IGBT module market. Nevertheless, the key application for power IGBT modules is undoubtedly EV/HEV, with an expected growth of 18% from 2019 to 2025, reaching $5.4B by 2025. Indeed, electric and hybrid electric vehicles (EV/HEVs) are being pushed by many countries, with subsidies to allow fast electrification of the passenger car fleet.

- The SiC MOSFET market is also expected to be driven by EV/HEVs, as SiC-based modules keep being adopted by several players, such as Tesla and BYD, and competing directly with IGBT modules in the main inverter for more compact and efficient designs. Moreover, SiC discrete transistors are directly competing with Silicon MOSFETs in onboard charger (OBC) systems for higher efficiency systems.

You can take a look at the sample and request the full report from Yole Développement right on their website.

Moreover, the analytical specialists from Omdia confirm that the wide-bandgap semiconductors market (GaN and SiC) will continue to grow and will reach 1 billion USD.

By the end of 2020, SiC MOSFETs are forecast to generate revenue of approximately $320 million to match those of Schottky diodes. From 2021 onwards, SiC MOSFETs will grow at a slightly faster rate to become the best-selling discrete SiC power device. Meanwhile, SiC JFETs are forecast to generate much smaller revenues than those of SiC MOSFETs, despite achieving good reliability, price, and performance.

Hybrid SiC power modules, combining Si IGBTs and SIC diodes, are estimated to have generated approximately $72 million in sales in 2019, with full SiC power modules estimated to have generated approximately $50 million in 2019. Full SiC power modules are forecast to achieve over $850 million in revenue by 2029. They will be preferred for use in hybrid and electric vehicle powertrain inverters. In contrast, hybrid SiC power modules will be used in photovoltaic (PV) inverters, uninterruptible power supply systems, and other industrial applications, mainly, delivering a much slower growth rate.

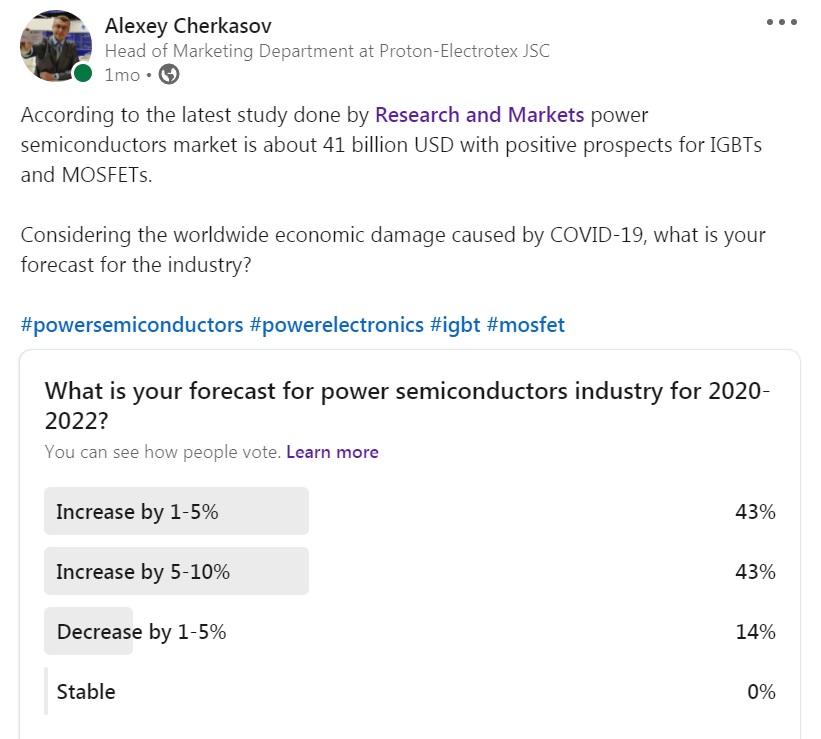

To conclude my investigation in this field I recently had launched a poll on LinkedIn, where I asked my colleagues from power semiconductors and power electronics industries to share their opinion on the future of power semiconductors market.

Over 80% are sure that we can expect an increase in power semiconductors market. And this is very inspiring because these answers come straight from the people who form this industry.

To sum it up, we can be sure that after the drop always comes the rise. So there is no doubt that power semiconductors market will continue to grow no matter what.

Stay tuned for more power semiconductors and electronics updates. Go to Marketing in Power Electronics section of the website to learn more about the industry.