The GE/McKinsey matrix is a product portfolio analysis matrix, that helps companies develop a product range strategy and decide which business units to invest in and which not. This matrix was first developed by the consulting company McKinsey&Co for General Electric in the 1970s.

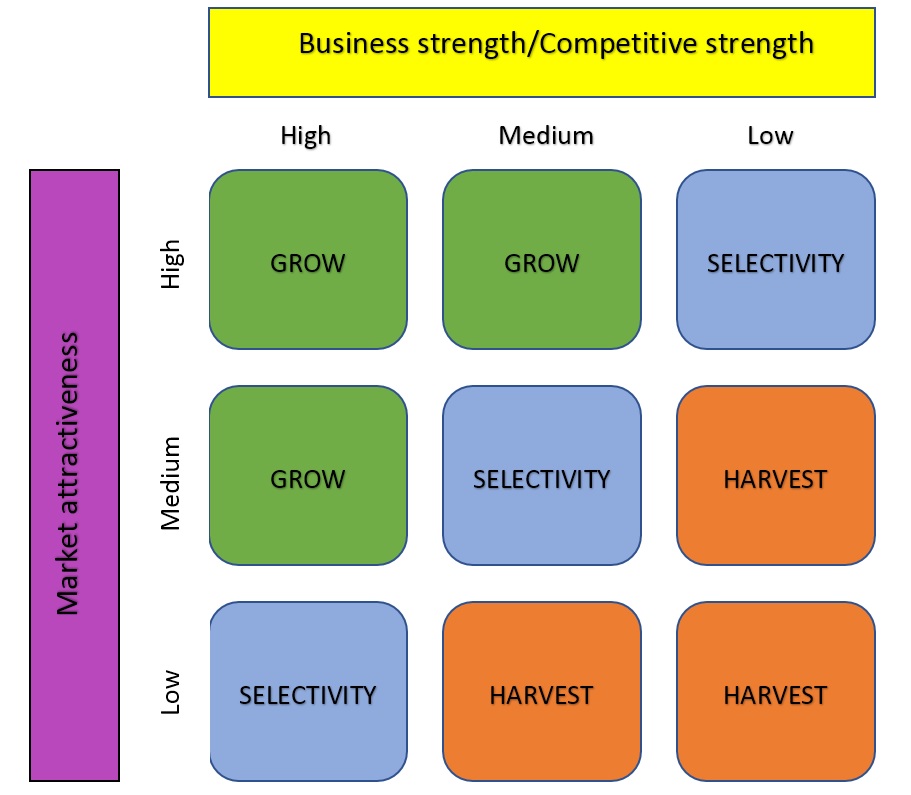

The GE/McKinsey model is a matrix that consists of 9 cells and is based on two main indicators of business evaluation: market attractiveness and business strength/competitive strength. Each indicator has three levels: high, medium, and low.

Market attractiveness

Market attractiveness means how profitable this market is for the company. The criteria of market attractiveness:

- market growth rate

- size of the market size

- average percentage of gross margin

- prospects of innovative technologies

- amount of investment required to enter the market or hold its position on it

- market profitability (entry barriers, exit barriers, supplier power, buyer power, etc.)

Business strength/Competitive strength

Business strength/Competitive strength helps you understand whether a company has the necessary capabilities to compete in a defined market. The criteria of business strength/competitive strength:

- existing market share of the company

- number of financial, technological and labor resources

- the quality and originality of the product

- image and reputation of the company

- company profitability

There are a lot of criteria for analysis, each company chooses its own set based on its goals.

As soon as you have assigned product value for its market attractiveness, as well as business strength/competitive strength, you need to enter the results in the appropriate place in the matrix. Once the product is in place, you can choose a strategy for the product.

The GE/McKinsey matrix has 3 main strategies: grow, selectivity, and harvest.

Grow

Products that are included in these cells (High-High, High-Medium, Medium-High) should be invested first. They are the most promising in the future and will bring large profits to companies. Typically, the following areas for investment in these categories are identified: scientific research and development, advertising, and capacity expansion.

Selectivity

Products that fall into these cells (High-Low, Medium-Medium, Low-High) have uncertain prospects. In this category, the product may not give the maximum results, even if the company has put resources in it. Usually, investments in these product groups are allocated only if companies have any money left after investing in “grow” cells.

Harvest

Products that match these cells (Medium-Low, Low – Medium, Low – Low) are not profitable in unattractive industries. In this case, you can either liquidate the business or sell it and invest in promising projects.

The GE/McKinsey matrix comes down to point to:

- Which business products and/or services are in priority

- What will only bring losses in the future

- Which business products/services should be invested in.

Find more analytical and strategic marketing information in the corresponding sections of the website.